IADA Releases Second Quarter 2025 Market Report: Optimism Emerges as Market Adjusts

DAYTONA BEACH, FL, UNITED STATES, July 28, 2025 /EINPresswire.com/ -- The International Aircraft Dealers Association (IADA) released its Second Quarter 2025 Market Report, revealing a stable market and emerging optimistic outlook among Accredited Dealers, Certified Brokers and Verified Products and Services Members.

Market perceptions from IADA members were gathered from a global cross-section of IADA-accredited dealers, brokers, and products and service providers and reflected improving confidence across most metrics compared to the first quarter. The results of IADA's member perception survey were compiled prior to the U.S. government reinstating bonus depreciation on purchases of factory-new and preowned aircraft, which could fuel additional market activity in the second half of the year.

IADA dealers reported 136 new acquisition agreements in the second quarter of 2025, on par with the second quarter of 2024. In Q2 2025, exclusive retainer agreements to sell aircraft were flat sequentially from Q1 2025 but down 35% YoY from Q2 2024. For the full year 2024, 1,176 such agreements were signed, up by 39% YoY from 846 in all of 2023.

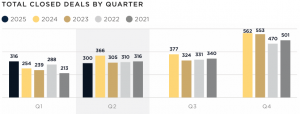

In the first half of 2025, IADA dealers reported 1,338 dealer leads generated through AircraftExchange.com, the association’s exclusive online marketplace, as highly qualified traffic continued to flow through the association’s proprietary system. Average monthly aircraft listings on AircraftExchange were up 12% YoY in the first six months of 2025, while the volume of closed deals (616 for the first half) was in line with and little changed from the first half of 2024 results.

“We’re already seeing a measured and positive shift in market sentiment,” said IADA Chair Phil Winters, who also serves as Vice President Aircraft Sales & Charter Management for Greenwich AeroGroup & Western Aircraft Inc. “Dealers are constantly adjusting and while the second quarter wasn’t a blockbuster, many are now gearing up for a stronger second half due to bonus depreciation, and waiting to see how tariffs may impact some sales.”

Survey Highlights

Buyers Begin Driving the Market: The second quarter score of 3.44 (on a 1-5 scale) marks the highest in a year for buyer influence, signaling increasing activity and control from the demand side.

Market Outlook Improves: The six-month projection for the aircraft sales market rose to 3.42, up from 3.20 in the first quarter.

Finance and Insurance Projections Tick Up: Aircraft finance outlook climbed to 3.06, from 2.93 in the first quarter, and insurance outlook rose slightly to 2.9, from 2.82.

Current Market Sentiment Holds Steady: While slightly down from the first quarter, the market’s current rating remains stable at 3.07, a modest reflection of evolving global conditions.

Pricing and Supply Trends

Pricing: Expectations suggest stable to slightly decreasing prices, particularly for light, midsize, and large jets. Turboprops remain the most stable segment.

Supply: Projected to slightly increase across all categories.

Inventory Willingness: Slightly decreased willingness to hold inventory, reflecting a more cautious stance among dealers.

International Reach

IADA’s second quarter survey reflects IADA’s international presence:

98% of survey respondents operate in North America

60% in Europe

57% in Latin America/Caribbean

38% in both the Middle East and Asia/Pacific

36% in Africa

To download the complete IADA Second Quarter 2025 Market Report go to Aircraft Exchange.

What IADA Marketing Experts Said, Prior to Enactment of Bonus Depreciation

Economic and Policy Uncertainty

“The global market is constrained by far too much economic uncertainty. Buyers are cautiously waiting for trade policy to settle down and the tax package to pass.” - Brent Dahlfors, Jet Transactions

“The post-election bizjet market euphoria in the U.S. has subsided since early April 2025. Despite more attractive pricing, tariff-related uncertainty and unpredictability have caused many potential buyers to take a time-out, at least for now.” - Rollie Vincent, Rolland Vincent Associates

“Surprisingly, among all of the tariff and equity market volatility over the past quarter, demand has remained healthy. Inventory continues a slow and steady increase, but buyers and sellers are meeting each other's expectations on pricing. Therefore, the 'months of supply' inventory remains healthy in the turboprop and light jet markets.” – Phil Winters, Western Aviation, Inc.

“I think lack of stability and random governmental decision making is a big deterrent to individuals and corporations who may have been considering making a change with aircraft.” - Byron Mobley, Wetzel Aviation, Inc.

“Everyone is taking a wait and see approach with regard to the effects of the tariffs.” - John Jelovic, Dassault Aviation

“Current activity is a bit sluggish. Maybe some weariness from global market uncertainty. However, all indications would point to an active and improving second half of the year.” - John Odegard, 5x5 Trading

Bonus Depreciation: A Key Driver

“Bonus depreciation lies at the core of anticipated increased activity in Q3/4 '25. If bonus depreciation passes, activity will surge and we may well find the market in same position as late ’22, ’23, ’24...rapid transaction pace coupled with challenged access to MROs for buyer due diligence (PPI).” - Johnny Foster, OGARAJETS

“Bonus depreciation could be a significant factor in driving buy side demand and increasing values.” - Pat Clarke, OGARAJET

“Activity level is average for us. Definitely see a small dip with tariffs and stock market turmoil. Expectation is that 100% bonus depreciation will return and second half of the year through year end should be busy.” - Daniel Cheung, Aviation Tax Consultants

“Market activity showed a predictable slowdown in closings during May, following the pause associated with Liberation Day. Looking ahead, the market’s direction in the second half of the year will be shaped by key policy decisions from the administration, particularly regarding tariffs and the future of bonus depreciation.” - Emily Deaton, JetAVIVA

Inventory and Sales Performance

“Our year-to-date engagement and sales results significantly exceed those from the same period in 2024. With relatively low supply remaining across the modern markets, we remain bullish for a robust Q3 and Q4 and encourage our clients and prospects to plan accordingly.” - Corey Westfall, OGARAJETS

“Inventory coming up in most markets, prices adjusting accordingly.” - Howard Henry, Eagle Aviation

“I think Q2 transactions will be down on Q2 2025 following what was a very strong Q1. I’m optimistic about Q3 and 4.” – Colin Dunne, Jetcraft

“Prices remain stable, most sellers are upgrading aircraft. Legacy aircraft (year 2000 or older) are continuing to decrease in value to almost pre-pandemic levels.” - Cameron Jones, Jones Aviation Group

“Transaction for newer jets in good condition remain relatively strong, supported by the limited availability of high-quality, late-model aircraft. Older jets with upcoming maintenance needs face more price pressure, longer market times, and increased buyer scrutiny due to operational costs and upcoming inspection expenses.” - Walt Wakefield, Jet Effect

Lending & Activity Levels

“We have seen a spike in Spring activity and hope to see one again in the Fall.” - Emily Meczkowski, AOPA Finance

“Activity appears to be returning to normal levels and buying cycles, however, insurance remains a concern for many potential buyers.” - Brian Macbean, AOPA Finance

“Somewhat slower and spotty in April and May, picking back up again for June. There are several distractions in the world, but some are getting comfortable with them. We’re seeing a good appetite from most banks to make aircraft loans right now.” - Sam Harris, JetLoan Capital

About IADA

The International Aircraft Dealers Association is a professional trade organization that sets the standard for excellence in the aircraft resale industry. IADA members are among the most experienced and respected professionals in the field, committed to maintaining the highest levels of integrity, transparency, and expertise. IADA-Accredited Dealers undergo rigorous vetting and continuous re-accreditation, ensuring that they meet the highest standards of professional conduct and service. IADA Products & Services members are verified to assure the highest ethical standards and levels of experience. For more information, visit https://iada.aero.

About AircraftExchange.com

IADA's AircraftExchange marketing search portal is the only site where every aircraft listed for sale is represented by an IADA-Accredited Dealer. AircraftExchange enables users to create a confidential dashboard of business jets for sale, filtered based on their features and amenities, class size, age, and price. Users can browse through data-rich listings for available business aircraft. For more info go to https://aircraftexchange.com.

Jim Gregory for IADA

James Gregory Consultancy llc

+1 316-706-9147

email us here

Visit us on social media:

LinkedIn

Facebook

X

Other

Distribution channels: Aviation & Aerospace Industry, Companies, International Organizations, Manufacturing, Travel & Tourism Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release