The 2025 Proxy Season in 7 Charts

The end of June marks the end of another proxy year, and the past year certainly looks very different from previous ones, particularly when it comes to sustainability.

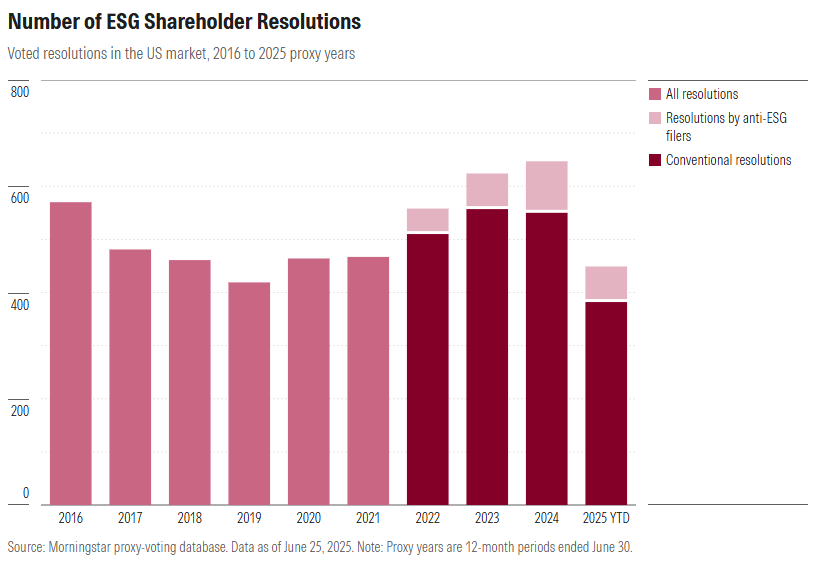

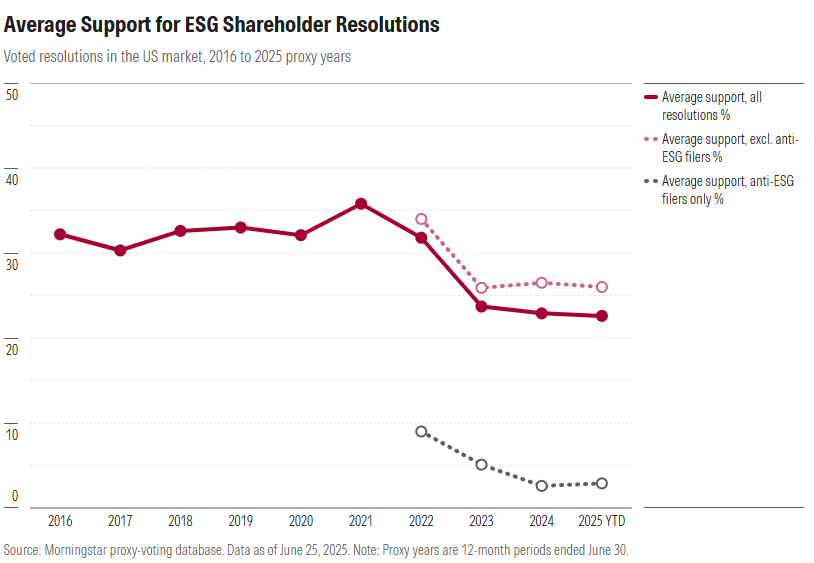

Overall, the number of ESG shareholder resolutions has fallen by around a third in 2025, but support levels have stabilized at just above 20%. Yet, once again, there’s a big difference in shareholder support for “G” resolutions on corporate governance compared with “E&S” resolutions on environmental and social themes.

Stabilizing Support for Far Fewer Shareholder Resolutions

The charts below illustrate the 2025 proxy year in the context of the last 10 years. They show a cut of Morningstar’s proxy-voting data as of mid-June, which is not the full proxy year, but it covers more than enough of the year to be able to draw out the key trends on the volume and shareholder support for ESG resolutions these past 12 months.

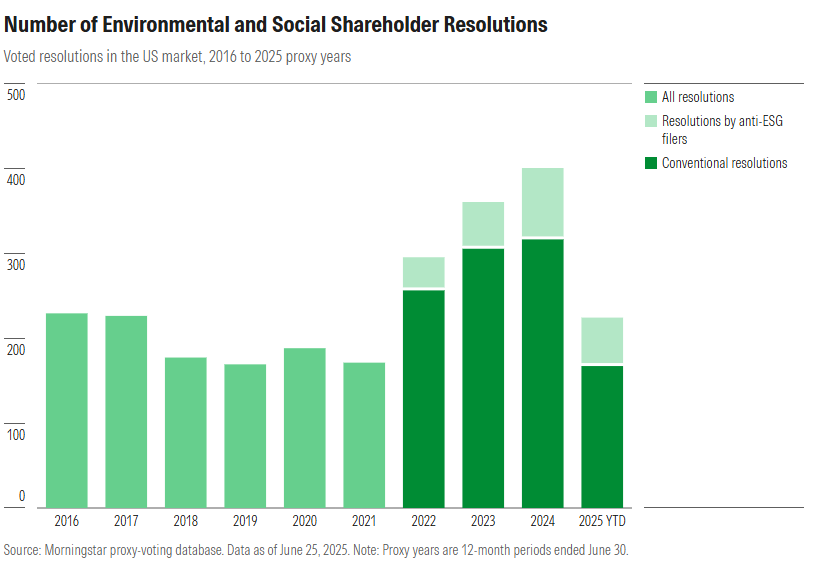

- The number of shareholder resolutions on ESG voted on at US companies is down by a third to 422 in the 2025 proxy year to date. That follows three years of steep volume growth. We can attribute this decline to guidance changes implemented by the Securities and Exchange Commission in February, which allowed companies to exclude many more shareholder proposals from the proxy ballot.

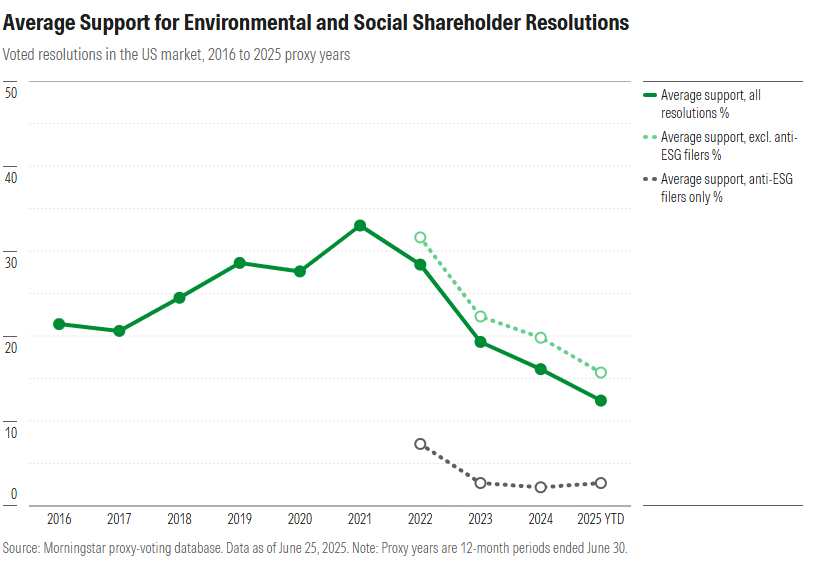

- The average level of support for ESG resolutions appears stable at 23% in 2025, settling at similar levels compared with the prior two years. And that appears to be the case whether you consider the entire population of votes or if you exclude the considerable proportion of proposals by so-called “anti-ESG” filers, which investors have tended to strongly oppose (after which the average increases to 26%).

Overall, it looks like shareholders who vote have found their preferred level of support for sustainability and governance resolutions, so the sharp declines in average support we saw a couple of years ago appear to be behind us.

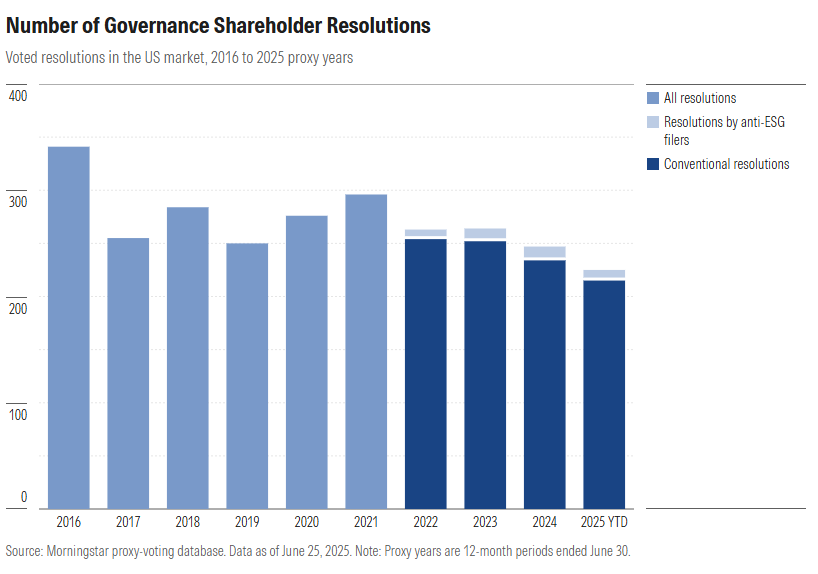

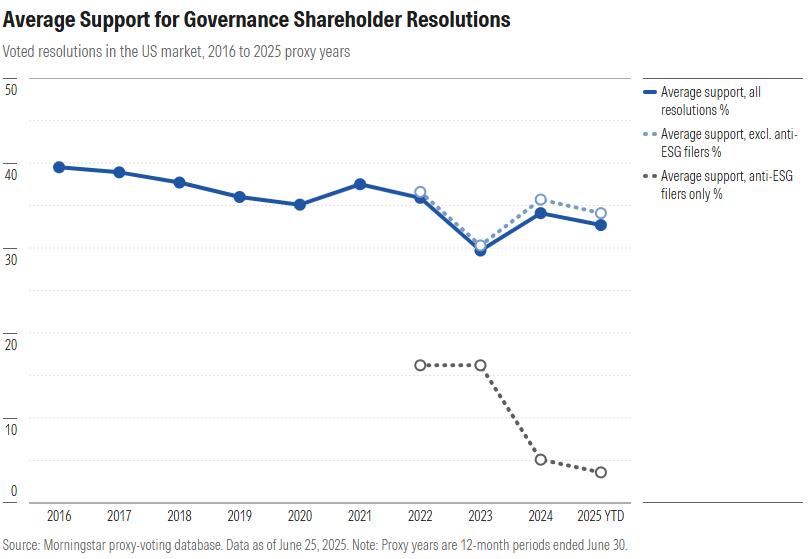

Strong Support for Governance Resolutions Holds Steady

However, the recent stability in support for ESG resolutions masks underlying strength for governance resolutions and weakness for those addressing environmental and social themes.

Last year, we saw a rise in average support for governance-focused resolutions as more of these proposals focused on shareholder rights. That trend continued in 2025—average shareholder support for governance resolutions stood at 33% in the 2025 proxy year, compared with 34% in the previous year. As there are relatively few anti-ESG resolutions addressing governance topics, excluding them only has a small effect on the average, as shown below.

Strongly Supported Environmental and Social Resolutions Become a Rarity

It’s a different story for environmental and social resolutions, though.

The number of E&S resolutions has shrunk significantly in the 2025 proxy year. While the volume of governance resolutions has fallen by 9% since last year, the volume of E&S resolutions is 44% down. As the chart below shows, our database captured 224 E&S resolutions in the 2025 proxy year, compared with 400 in 2024.

Over that period, average support for those resolutions fell to 12% from 16%. However, if we exclude resolutions by anti-ESG proponents, this year’s average stands at 16%, down from 20% in 2024. This indicates that the largest asset managers’ appetite for supporting E&S proposals has continued to wane.

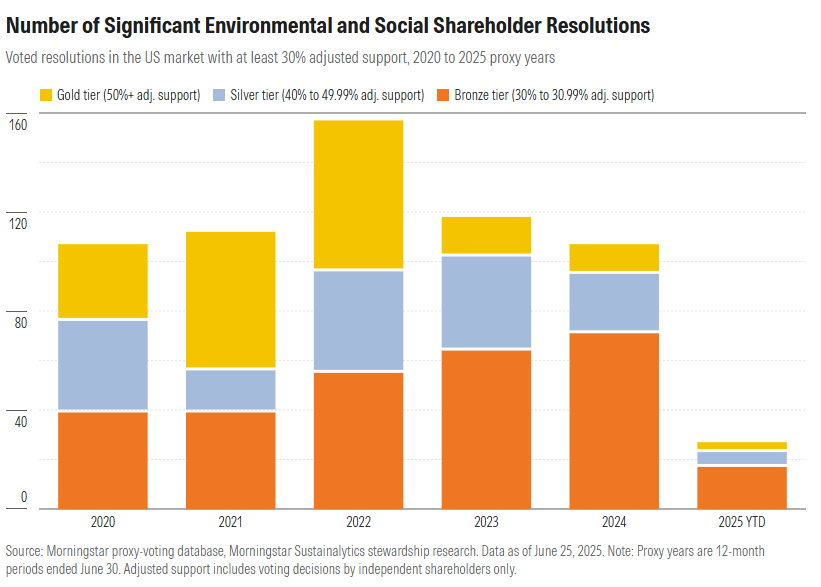

There’s more evidence of that waning appetite for environmental and social resolutions if we look at the population of significant E&S resolutions, or those that achieve the support of at least 30% of a company’s independent shareholders. The number of significant E&S resolutions is sharply down from 107 in the 2024 proxy year to only 27 in 2025.

The fact that there are so few of them this year indicates a further shift in underlying investor sentiment toward sustainability, particularly among the largest asset managers.

This means there will be plenty to analyze later this year when asset manager voting records are published. But it also highlights why it’s becoming increasingly important for sustainability-focused investors to make the most of their manager selection and proxy-voting choice options, so as to better align proxy-voting decisions with their own environmental and social priorities at a time when asset managers are backing away from doing so.

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release